Successful companies recognise that keeping their employees happy is a cost-effective way to attract and retain talent, improve morale and hence grow productivity and profit.

Get in Touch

Employee Benefits

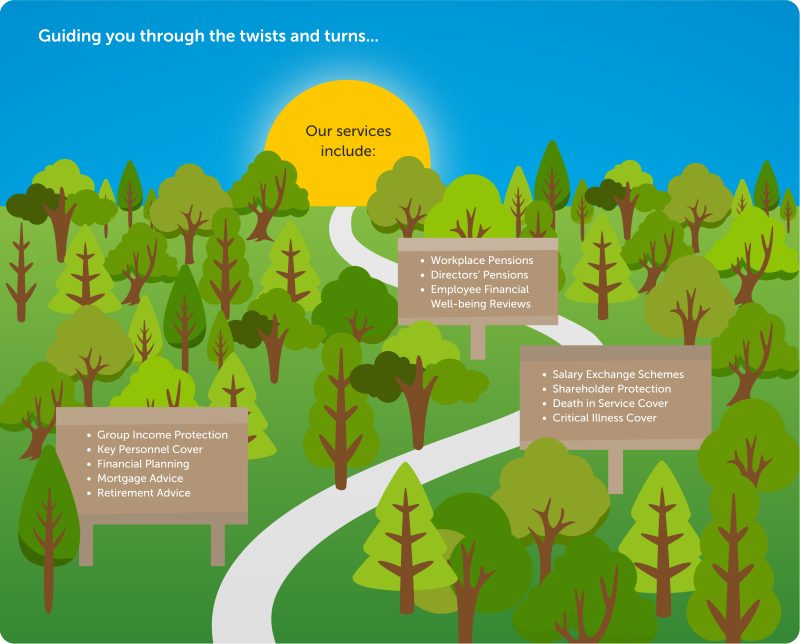

At Cowens our Chartered Financial Planning expertise encompasses Employee Benefits – an independent workplace advice consultancy specialising in creating and implementing workplace benefit packages that meet the specific needs of your business as well as helping your employees plan for a secure future.

From guidance for directors to protecting your employees’ financial well-being, we help you take care of your greatest assets.

A 2019 study of workers* found that over half are looking for benefits to improve their work/life balance, with the majority of workers surveyed believing that their employer has a responsibility to look after their personal well-being.

For the rough and the smooth, get on track to tailored, transparent and tax-efficient advice

As with our other Financial Planning services we take time to get to know you and understand your specific needs; from small companies to major corporations, we appreciate that you and your business are unique. Our honest, transparent approach and breadth of experience allows us to recommend solutions that are tax-efficient both for your business and your employees.

In implementing those solutions we believe that effective communication is the key. That’s one of the reasons why we also offer financial well-being sessions for employees to explain the advantages, maximise your generosity and reduce financial anxiety. We will work with you to ensure that employees fully understand the value of the recommendations and that you derive maximum value from your commitment.

Alongside attractive benefit packages that offer added-value and reassurance for individuals we also offer risk management strategies designed to protect shareholders’ interests in respect of replacing key personnel or protecting the business in the event of difficult unforeseen circumstances. We can help ensure minimum disruption to the business even should the worst happen and a co-shareholder die or be diagnosed with a critical illness.

If you’d like to keep your staff secure and motivated, whilst maintaining tax-efficient cover that offers protection in every eventuality, let us absorb the responsibility of creating and implementing a tailored and effective employee benefits package, whilst you get on with what you do best – running your business.

The Financial Conduct Authority do not regulate tax planning.

Put your People on the right path…

Employee Financial Well-being Reviews and Support

We believe financial guidance and support has never been so important. Financial stress is intrinsically linked to overall well-being and, particularly in challenging economic circumstances, financial anxiety can adversely affect mental health and performance.

We offer annual one-to-one Financial Well-being sessions for your employees, to help them manage their money and get advice on everything from everyday spending to workplace pensions, mortgages, investments and financial protection. These are confidential 1:1 sessions, delivered in a manner to minimise disruption to the business, with conversations tailored to and guided by the individual’s specific requirements. We find that guidance is required on different subjects at different times of life. Typically we might help with questions including:

- 20s – How to best save for a house deposit and what is the house buying/mortgage process?

- 30s – How do I best secure the future for my young family?

- 40s – Am I best to pay off the mortgage or save more?

- 50s – How do I best save for retirement?

- 60s – Can I afford to retire? How do I draw money out of my pension?

Should employees need specific mortgage advice, we can share the expertise of in-house Mortgage Advisers and offer discounted fees to your employees as existing Cowens’ clients. More bespoke, in-depth sessions can also be arranged for members of your senior leadership team.

Employees can not only understand and capitalise on the benefits available to them but are reassured that, as an employer, you value their financial and wider well-being and support them on their personal and business journey.

Planning for secure financial futures…

Workplace Pensions

Cowens Employee Benefits can also help maximise the benefits of workplace pension savings for team members at all levels. We can help create and manage workplace pension solutions to reward and protect your employees. Or talk to our experts about the most effective and tax-efficient options for Directors’ Pensions. From specialist investment plans such as a Self-Invested Personal Pension (SIPP) or Small Self-Administered Schemes (SSAS) we can provide recommendations and help implement solutions to maximise your current and future financial security.

Retirement Planning

Whether you’re a director or an employee, we’re with you as you approach retirement. Our Financial Planning partners can help you make the right financial decisions to fulfil your future plans. From capitalising on savings and investments to drawing down your pension in the most tax-efficient way, we offer practical, transparent strategies to help you finance your retirement and provide a lasting legacy for your loved ones.